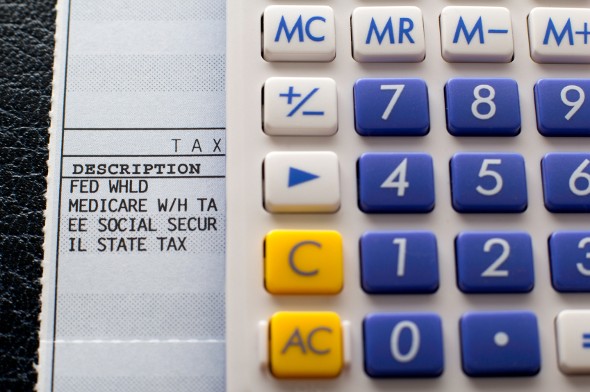

Americans Have to Pay a Social Security Tax on Every Paycheck. What Is the Rate?

According to the U.South. Department of the Treasury, payroll taxes made upwards approximately 31% of federal tax revenue in financial year 2021. That'due south $1.25 trillion out of $4.05 trillion. These taxes come from the wages, salaries, and tips that are paid to employees, and the government uses them to finance Social Security and Medicare. Employers withhold payroll tax on behalf of their employees and pay it direct to the government. If you take a close wait at your earnings statement, y'all'll come across that payroll taxes take a serious bite out your paycheck. Only a financial advisor can wait at your tax state of affairs and assistance y'all reach your financial goals.

Check out our income tax calculator.

Payroll Taxation Definition

Payroll taxes are role of the reason your take-habitation pay is different from your salary. If your wellness insurance premiums and retirement savings are deducted from your paycheck automatically, then those deductions (combined with payroll taxes) can result in paychecks well below what you would get otherwise. When you start a new task and fill up out a West-iv tax withholding form, your employer starts deducting land and federal payroll taxes from your earnings to pay for Social Security and Medicare.

Social Security taxes began in 1937, at a pocket-size rate of 2%. Medicare hospital insurance taxes didn't kick in until 1966, at a rate of 0.7%. Rates have climbed since so, of form, with the charge per unit increase for Social Security taxes outpacing the rise in Medicare infirmary insurance taxes.

In 2021, Social Security taxes but use to the first $142,800 of income, and in 2022 they volition apply to the kickoff $147,000. The income cap on payroll taxes has led some to criticize the payroll taxation. Those who desire to reform the payroll tax call it a regressive taxation – 1 that doesn't crave the rich to pay more.

In tough economical times similar the Smashing Recession, Congress cuts payroll taxes to give Americans a fiddling extra accept-home pay. Recently, President Trump allowed employers to temporarily suspend withholding and paying payroll taxes in an attempt to offering COVID-19 relief. When cuts like these elapse, it reignites the debate over how payroll taxes work.

Related Article: Tax Prep Checklist

Employer Payroll Tax

Employers pay a share of some payroll taxes for their employees. That'southward why if you become from being an employee of someone else to beingness self-employed your payroll revenue enhancement liability will double. Information technology'southward something to upkeep for if you're thinking of making the spring to cocky-employment.

Before 1989, the revenue enhancement rate for self-employed people was less than the combined taxation charge per unit on employers and employees. Those days are over, though. The IRS recently announced that it volition be groovy downwardly on employers who don't collect enough money in payroll taxes. If yous're a business owner, have note.

Nether the umbrella term "payroll taxes," employers are required to withhold state and federal income taxes from their employees' earnings, as well as Social Security and Medicare taxes. These last two taxes are known as FICA taxes, later the Federal Insurance Contributions Act. Federal payroll taxes are consistent beyond states, while state payroll taxes vary co-ordinate to the income taxation rates in each state.

The portion of payroll taxes that the employer withholds on behalf of the employee are liabilities for business accounting purposes. The employer is playing the role of an amanuensis for the regime, collecting taxes from employees and remitting them to the state and federal government. Withal, the matching share of FICA taxes that the employer pays on is considered a business expense, not a liability. Because it's a business expense it tin be written off at tax fourth dimension.

Related Article: The Lowest Taxes in America

Payroll Tax Rates

The current tax rate for Social Security is 6.2% for the employer and half-dozen.2% for the employee, for a full of 12.4%. The current rate for Medicare is one.45% for the employer and 1.45% for the employee, for a full of 2.9%. That means that combined FICA revenue enhancement rates for 2021 and 2022 are 7.65% for employers and vii.65% for employees, bringing the total to 15.three%.

A recent written report from the Congressional Budget Function suggests that raising Social Security payroll taxes is necessary to extend the solvency of the Social Security Trust. As discussed, raising the maximum taxable income might be a complement or an alternative to raising payroll taxation rates.

Since 2013, loftier-income folks accept had to pay a little actress in Medicare payroll taxes under a provision of the Affordable Care Act. This boosted Medicare Taxation adds 0.nine% to the employee-paid portion of payroll taxes above a certain income threshold.

For single filers, that threshold is $200,000. For married couples filing jointly the income threshold is $250,000. Married filing separately? Your income threshold is $125,000. Say y'all're a unmarried filer. The first $200,000 of your salary will be subject to the regular 1.45% employee-paid Medicare taxation. Every dollar to a higher place $200,000 will so be taxed at 2.35% (i.45+0.ix=2.35).

Lesser Line

Payroll taxes reduce your accept-domicile pay. But, since they are deducted from your earnings, y'all won't take to pay a huge tax nib one time a year. This can make it easier to manage your money and it may fifty-fifty go you a refund come tax time. That is why it's important to fill out your W-iv tax withholding grade correctly when you lot first a new task, and update it as needed, since this determines how much your employer withholds from your paycheck.

Tax Planning Tips

- Finding the right financial counselor that fits your needs doesn't have to be difficult. SmartAsset's free tool matches you with financial advisors in your expanse in 5 minutes. If y'all're ready to exist matched with local advisors who can help you lot attain your fiscal goals, get started now.

- In that location are many ways to lower your taxes. A fiscal counselor can help you find the best strategy for your financial goals and needs. If you are self-employed, an advisor tin aid you avert employment taxes by structuring your business to pay you in dividends instead of a salary.

- If yous're freelancing on the side, you lot'll need to pay taxes on that actress income. You can pay estimated taxes quarterly or become more than taxes withheld from your paycheck. The SmartAsset federal income taxation calculator can help y'all figure out how much to withhold. (You lot'll need a pay stub to see how much you are paying in taxes and how much more you owe.)

Photo credit: © iStock/Ahlapot, © iStock/i_frontier, © iStock/GaryPhoto

greenhalghtedy1974.blogspot.com

Source: https://smartasset.com/taxes/all-about-payroll-taxes